SEC Form 4 – Comprehensive Report

The Ultimate Guide to Understanding SEC Form 4 for Investors

Overview of SEC Form 4

SEC Form 4 Comprehensive Report for Investors – The Securities and Exchange Commission’s (SEC) Form 4 is a pivotal document for investors, insiders, and market analysts alike. Stemming from the rigorous regulations of the Securities Exchange Act, this form stands as a cornerstone of mandatory filings that bolster market transparency.

SEC Form 4 is instrumental in providing a glimpse into the transactions conducted by company insiders, which encompasses directors, officers, and significant shareholders. When these individuals trade their company’s stock, whether engaged in buying shares or disposing of their holdings, SEC Form 4 offers real-time insight into their actions. This is key for investors seeking signals regarding the financial health and future prospects of corporations.

Understanding the nuances of Form 4 is paramount for those vested in the equities market. It’s not solely about being privy to insider trades but also the interpretation of the underlying motivations that fuel these transactions. Could a cluster of insider acquisitions signify bullish confidence, or do substantial disposals suggest a bearish future?

Insider trading can influence stock price movements considerably, and thus, monitoring reports filed with the SEC is a strategic approach that can wield advantageous outcomes. With stringent requirements, including the expectation to file within two business days following a transaction, the SEC ensures that the market reacts to the latest insider trading data promptly, maintaining an equilibrium of info and preventing the abuse of material nonpublic information.

Navigating through the EDGAR system, investors have the power to search and dissect Form 4 filings. By decoding transaction codes and assessing the quantity and price of recent insider trades, savvy investors glean valuable insights. This knowledge can guide investment strategies, whether through anticipating market reactions or understanding longer-term trends in insider behavior.

As we delve into the layers of insider transactions, ownership declarations, and legal implications, we unveil a world of trading dynamics. Let us embark on this journey to unearth the symbiotic relationship between SEC Form 4 filings and informed investment decision-making.

Importance of Insider Trading Insights for Investors

In the dynamic landscape of the stock market, insider trading insights become invaluable intel for investors diving deep into securities research. A company’s SEC Form 4 filings act as a beacon, shedding light on the investment decisions made by those who walk the corridors of power within the company—executives, directors, and significant shareholders known as insiders. These filings are not mere administrative paperwork; they are rich with clues about the inner workings and strategic directions of businesses.

The essence of decoding Form 4 lies in its ability to provide a direct line of sight into the financial commitments insiders are making in the very companies they steer. For investors, these filings on the EDGAR system can be as telling as any earnings report or industry forecast. They provide a narrative of confidence or caution, with insiders potentially leveraging their nuanced understanding of the company’s potential through their trading patterns.

When an insider decides to acquire more shares or exercise their stock options, it often signals a bullish outlook, possibly indicating an expectation of positive future developments that could enhance the company’s stock price. Conversely, if insiders are selling shares, it may be interpreted as bearish, prompting investors to question what could be prompting such dispositions.

However, insider transactions should not be viewed in isolation. Utilizing the broader spectrum of SEC filings, investor education resources, and financial analysis can yield a comprehensive picture. For instance, a lone insider sale might not reveal much, but a pattern of sales across several insiders within a short timeframe could raise a red flag.

Gaining insights from insider buying and selling provides a crucial edge in an investor’s arsenal. As trading plans, market conditions, and industry outlooks continuously evolve, the strategic observation and analysis of Form 4 filings underscore the undeniable relevance of these insights. By staying informed about insider trading activities and leveraging these actionable data points, investors can make more enlightened decisions—grounded in the real-time maneuvers of those with an intimate knowledge of a company’s prospects.

Brief Explanation of the Securities Exchange Act and the SEC’s Role

The tapestry of the financial markets is intrinsically interwoven with regulatory frameworks designed to maintain fairness, transparency, and integrity—principal among these is the Securities Exchange Act of 1934. This federal law, a cornerstone of market regulation, established the U.S. Securities and Exchange Commission (SEC), entrusting it with a mandate to oversee and enforce securities laws.

The Act was enacted in response to the stock market crash of 1929 and the subsequent Great Depression, both of which were exacerbated by a lack of market transparency and rampant insider abuses. Its creation marked a pivotal shift in how securities would be traded and monitored, paving the way for investor protections that are fundamental to the credibility of the U.S. financial system.

Within the broad swath of responsibilities, the SEC’s role extends to ensuring public companies comply with rigorous reporting standards. It is the SEC that dictates the norms for disclosures of trades by company insiders through forms like SEC Form 4. Investors rely on this information, filed within two business days after an insider transaction, to assess market conditions and make informed decisions.

The SEC also promulgates rules governing the behaviors of insiders, aiming to prevent illegal insider trading—an offense characterized by trading based on material nonpublic information. This enforcement of the federal securities laws, including the Securities Exchange Act, is quintessential for the preservation of investor confidence and for promoting the concept of a level playing field.

Form 4 filings serve as a crucial tool implemented by the SEC to maintain market integrity. For every insider transaction, from buying shares to awarding stock options, disclosure is not just a regulatory formality but a submission to the overarching principle of market transparency championed by the SEC.

Through the consistent application of the federal securities laws and real-time enforcement, the SEC plays a critical role in the functioning of America’s securities markets. The Act and the SEC together create an ecosystem where information asymmetry is minimized, ensuring that all market participants, from individual investors to institutional traders, operate with access to the essential knowledge required to undertake securities exchange transactions with confidence.

What is SEC Form 4?

Embarking on the journey to comprehend the mechanics behind insider trading inevitably leads us to the pivotal role of SEC Form 4, the ‘Statement of Changes in Beneficial Ownership’. This regulatory form, crucial to the U.S. Securities and Exchange Commission’s (SEC) mission, offers a window into the trading behaviors of company insiders, including officers, directors, and significant shareholders, who are often privy to material nonpublic information about their companies.

SEC Form 4 falls within the purview of the Securities Exchange Act of 1934 and is a key component of the SEC’s commitment to ensuring market transparency and fairness. When these insiders—or any individual with more than 10% ownership in a company—buy or sell shares or make any transactions that affect their beneficial ownership, they must file a Form 4.

This form is not just a ledger of transactions; it is a legal obligation that offers a signal to the market and investors. By deciphering the details encrypted within, such as transaction codes, or analyzing the acquisition or disposition of equity securities, one can gain insights into the confidence level insiders have toward their company’s stock and the market’s future movements.

Understanding SEC Form 4 is integral for investors who seek to interpret insider actions as either endorsements or red flags. A form filled with insider purchases can be indicative of a belief among those in-the-know that the company is on the cusp of growth—perhaps not immediately reflected in the stock price. Conversely, insider sales could hint at a potential downturn on the horizon or may simply reflect personal diversification or liquidity needs.

The significance of SEC Form 4 extends beyond the basics of reporting; it reflects the intersection of legal compliance, insider sentiment, and the potential forecast of the company’s trajectory. By law, insiders must file Form 4 promptly—within two business days—following the transaction date, providing timely info and a level of immediacy that can prove critical for investors tracking the market’s pulse.

As we unfold the layers of SEC Form 4, we uncover not just a form but a treasure trove of insights. It’s a medium that bridges the informational divide between those who govern a company and those who invest in it, thus serving as a crucial instrument in the investor’s toolkit for informed decision-making.

Definition of SEC Form 4

SEC Form 4 stands as a critical document within the sphere of federal securities laws, serving as the cornerstone of transparency and regulatory compliance. Defined by the U.S. Securities and Exchange Commission (SEC), Form 4 is legally mandated for reporting the changes in beneficial ownership of securities by corporate insiders. These individuals—executives, directors, large shareholders, and anyone possessing more than ten percent of a company’s stock—must file this form following transactions within a stringent timeline to ensure timely public disclosure.

At its core, SEC Form 4 is an attestation of insider trading activity, whether it’s the exercise of stock options, the acquisition of additional shares, or the disposition of owned stock. It is a declaration that provides the market a snapshot of insider sentiment, enabling investors to analyze transactions within the framework of federal securities laws and the Securities Exchange Act of 1934. The form is integral to policing the fairness of the securities market, deterring illegal insider trading by making such transactions visible.

The requirement to file a Form 4 within two business days of a material transaction introduces a level of immediacy and relevance not found in other filings. This prompt reporting is crucial for maintaining an equitable info exchange within the securities exchange market, allowing investors to react to insider behaviors that might reflect nonpublic info about company prospects or industry dynamics.

Understanding the SEC Form 4 involves recognizing transaction codes—such as P for purchase, S for sale, and G for the gift of securities—which convey the nature of each action. It includes assessing the price at which a security was bought or sold, as well as the quantity of shares involved. All these details combined provide a transparent record of transactions, painting a vivid picture of the market’s inner workings.

The presence and meticulous details within SEC Form 4 go beyond a mere formality; they echo the SEC’s commitment to fostering an informed investor base and a fair trading environment. For investors, the ability to scrutinize these filings can be a valuable component of their market research and can help sharpen their investment strategies based on the recorded actions of company insiders.

Legal Context: Federal Securities Laws and Insider Reporting Requirements

In the intricate web of financial regulation, the marriage of federal securities laws and insider reporting requirements plays a vital role in guarding the sanctity of the U.S. securities market. At the core of these legal stipulations lies the Securities Exchange Act of 1934, which fosters transparency, prevents fraud, and closely monitors insider trading in the marketplace. It orchestrates the reporting cadence and compliance that insiders must adhere to, ultimately ensuring that investors are not left in the dark about significant ownership changes in publicly traded companies.

Insider reporting requirements are formulated to curb the misuse of material nonpublic information—a type of insider info that can provide an unfair advantage in securities trading. The SEC sets specific mandates through rules and regulations such as Section 16 of the Exchange Act, distilling the essence of these requirements into actionable filings like SEC Form 4. It imposes upon insiders the duty to report transactions, thus contributing to an environment where information asymmetry is markedly reduced.

These filings serve as the linchpin in the federal securities law framework, creating an equilibrium where the transparency of insider transactions mirrors the expectations of investor protections. The pinpoint focus on timely filing—within two business days—is a testament to the urgency and significance federal securities laws place on disclosure. This element of immediateness underscores the SEC’s intent to maintain a current and continuous narrative on insiders’ relations with their respective company securities.

Moreover, the legal context intertwines with the material events that insiders report on the Form 4. Such activities may include the purchase and sale of common stock, the exercise of stock options, credit transactions with broker-dealers, and even the reception or giving of gifts. Notably, each transaction code embedded within the form reveals the nuances of these activities, giving investors a clearer view of insider intentions and the financial currents brewing within a company.

Adherence to federal securities laws and their reporting mandates is not just a legal formalism—it is an affirmation of the fiduciary duty insiders owe to shareholders and an acknowledgment of the broader societal trust placed on corporate governance structures. For the investor community, it provides the necessary rigor to critically assess the complex interplay of insider transactions, transforming SEC Form 4 from a mere filing into a definitive symbol of market integrity.

Entities Involved: Securities and Exchange Commission (SEC), Insiders, and Investors

The ecosystem revolving around SEC Form 4 is composed of several key entities, each playing a distinct yet interdependent role that underpins the financial market’s structural integrity. At its nexus is the Securities and Exchange Commission (SEC), a stalwart agency charged with the enforcement of federal securities laws, such as the pivotal Securities Exchange Act of 1934, which lays the groundwork for continuous, transparent disclosure in the world of securities exchange.

The SEC serves as the watchdog, ensuring that the form and its disclosures align with the statutes intended to protect investors and maintain fairness in the marketplace. Its mandate encompasses the supervision of insider transactions, the provision of investor relations resources, and the establishment of protocols for the ownership and exchange of securities. The transparency achieved through systematic SEC filings is a cornerstone of the agency’s obligation to investors—an effort to maximize access to financial info, investor education, and compliance oversight.

Insiders of a company—executives, directors, officers, and any individuals or groups holding more than ten percent of any class of a company’s stock—constitute another pivotal entity in the SEC Form 4 narrative. These insiders are privy to the inner makings of their respective companies and possess insights that go beyond the public sphere. Their transactions, whether through direct stock purchases, sales, or derivatives, are closely observed as they have the potential to reflect the internal financial apparatus of a company.

Investors, ranging from the Silicon Valley business elite to the average stockholder, rely on the symbiotic relationship between the SEC and insiders for cues on market behaviors. They scrutinize SEC Form 4 filings for material nonpublic information that could be inferred from insider trading activities. Savvy investors leverage these insights to inform their strategies, often incorporating the reading of SEC filings into their regular market research routines.

Together, these entities—SEC, insiders, and investors—create a triad of accountability, insight, and action that fuels the engine of the securities market. The bearings of their interactions are lubricated by the rich data provided within SEC Form 4 filings, which manage to encapsulate complex industry relationships and financial transactions and present them through an accessible and regulated format. Understanding the roles and interplay between these entities is essential for anyone engaged in the securities exchange commission market who aims to utilize SEC Form 4 as a beacon for informed financial decisions.

Why Form 4 Matters to Investors

SEC Form 4 is not just a regulatory requirement, it’s a treasure trove of data that speaks volumes to investors about the innermost convictions of company insiders regarding the firms they help operate. In the world of securities exchange, where information is as valuable as currency, this form provides a significant gauge of insiders’ confidence in their company’s prospects.

Understanding the transactions disclosed through Form 4 is integral to discerning the financial strategies of company directors, officers, and owners holding substantial shares. When these insiders engage in the trading of their company’s stock, they signal to the market about their perception of the company’s value. Whether they are buying shares, indicating a bullish outlook, or selling them, possibly hinting at a bearish future, the implications for investor trading strategies can be profound.

Form 4, with its detailed transaction codes, throws light on the nuanced intentions behind each insider trade. Insights into why insiders might exercise stock options or dispose of their shares within certain business days can give investors a leading edge in the market. For instance, a flurry of insider buying could presage a rise in stock price, while a wave of selling might suggest it’s time to pull back or even consider short positions.

Moreover, the SEC requires that Form 4 filings occur within two business days of the transaction, a rule that underscores the immediacy with which the market needs this information. This prompt reporting ensures that all market participants can trade on an even playing field, armed with the latest data on who in the upper echelons of a company is moving their pieces on the stock market chessboard.

The importance of Form 4 to investors cannot be overstated. It acts as an early warning system, a research tool, and a compass that helps gauge market sentiment. By carefully analyzing these filings, investors can glean insights into corporate governance and make more informed decisions on equity securities, potentially leading to more profitable outcomes in both bull and bear markets.

Impact of Insider Transactions on Stock Price and Market Perception

The influence of insider transactions on stock price and overall market perception is substantial; it wields the power to sway investor sentiment and drive the ebb and flow of equity securities trading. SEC Form 4 filings furnish investors with a direct line of site into these transactions, which, when acted upon, can lead to stock market movements grounded in the actions of those who know their companies best—corporate insiders.

Insiders, loaded with a repository of potent company insights, can set off market private signals through their buying and selling activities. A director’s purchase might be construed as a bullish gesture, a glimpse into the insider’s belief that the company stock’s price will rise due to impending positive developments. Conversely, if insiders are collectively initiating sales and stepping away from their shares, it can paint a bearish image, casting a shadow on investor relations and possibly leading to a dip in the stock’s valuation.

These transactions, made in the open market or otherwise, are diligently reported within two business days via SEC Form 4, which feeds into the industry’s thirst for timely and actionable financial info. The strategic use of this info can help construct a panoramic view of a company’s financial health—a mosaic whose pieces include filings, ownership stakes, and price qty disclosures that speak volumes about insider convictions.

Furthermore, Form 4 can amplify or tone down the relationship between stock options and market actions. When insiders exercise options and hold onto the acquired shares, it endorses the long-term value of the stock; but should they sell immediately upon exercise, questions may arise about both the company’s immediate and future valuation.

For investors, tracking and interpreting the subtle cues from insider trades becomes a critical research component—a way to peer into the ‘black box’ of corporate decisions and strategic direction. The filings shine a light on the relationship dynamics between investors and company management, providing an empirical basis on which to either forge or retract investment commitments.

In the intricate ballet of the stock market, SEC Form 4 serves as a choreographer, orchestrating a narrative of insider activities that has a profound impact on investor perception and market pricing. Keeping a close eye on these insider transactions can offer investors a deeper understanding of market mechanics, equipping them with the knowledge to navigate the nuances of an ever-changing financial landscape.

Signals of Bullish vs. Bearish Sentiment from Company Insiders

Interpreting signals of bullish and bearish sentiments from company insiders is a crucial aspect for any investor using SEC Form 4 filings as a guide to navigate the securities market. These filings stand as a clear demonstration of insider confidence – or lack thereof – and can significantly influence the decisions of investors who read these tea leaves in the hopes of gleaning investment insights.

When a company insider executes a purchase of additional shares, it is often interpreted as a bullish signal. Such insider buying denotes an implicit conviction that their stock is undervalued or poised for a positive trajectory, making it a potentially lucrative purchase. Behind every ‘P’ for purchase on a Form 4, investors might see a beacon signaling a strong vote of insider confidence which, when aggregated, could presage an uptrend in the company’s stock value.

Conversely, when insiders start selling their holdings, signified by transaction code ‘S’ on Form 4, the market may perceive this as a bearish indicator. This selling activity could suggest that insiders anticipate a decrease in stock prices, looming negative developments within the company, or perhaps broader industry downturns. In response, investors may re-evaluate their stake in the company and consider whether following suit is a wise decision.

Distinguishing between these insider sentiments requires more than a cursory glance at the forms. Investigative acumen is necessary, considering factors such as the volume of shares traded by insiders, their relation to the insider’s total holdings, and the context of the broader market and company-specific news. A single transaction may not yield a definitive sentiment, but observed patterns of insider behavior over time can provide more conclusive evidence of underlying confidence levels.

Moreover, expert investors don’t just observe these behaviors in isolation but contextualize them within the company’s fiscal year, the performance of securities within its industry group, and the performance of the market as a whole. Combining insights from SEC Form 4 with other elements like trading plans, options exercises, and patterns in beneficial ownership, paints a richer image of the potential future performance of a company’s stock.

In the end, SEC Form 4 filings are more than formal compliance with federal securities laws; they are the narrative thread weaving through the fabric of the company’s story, providing essential clues to investors about the prevailing wind directions of insider sentiment – bullish or bearish – that shape the sails of the stock market.

Importance of Beneficial Ownership Reporting for Investor Confidence and Market Integrity

To the vigilant investor, beneficial ownership reporting is a pivotal piece of the financial puzzle, acting as a beacon of transparency in the often opaque waters of securities markets. SEC Form 4 is an integral part of this disclosure landscape, with its mandated reporting of changes in beneficial ownership by company insiders. Such disclosures are paramount for sustaining investor confidence and maintaining the market’s structural integrity.

Beneficial ownership, as reported on Form 4, provides clarity on which insiders are increasing their stakes in their company – a potential signal of bullish confidence – or conversely, who may be divesting, which could hint at bearish trends. The insights gleaned from this ownership data allow investors to align their interpretations with the actions of those who steer the corporate ship – insiders whose decisions may be informed by material nonpublic information.

The transparency that beneficial ownership reporting via SEC Form 4 provides is not a trivial feature of the securities exchange landscape; it is a backbone principle enshrined by the Securities Exchange Commission. This reporting underscores a profound respect for the equitable provision of information, which is essential to ensure that all investors, regardless of their stake in a company, have access to critical trading information within business days of insider transactions.

Without the robust framework of beneficial ownership reporting, investor relations could be marred by suspicion, and market integrity could be compromised. It is this reporting that helps to deter potential abusive practices related to insider trading and serves as a hallmark of a well-regulated market. In its essence, SEC Form 4 embodies the SEC’s commitment to fostering a level playing field where investor education is not just encouraged but bolstered by real-time, accessible, and reliable data.

Moreover, when investors can readily observe the financial commitments of insiders, they gain confidence in the investment environment. This assurance is critical in a market driven by perceptions and reactions to the myriad of transactions that take place each day. Indeed, beneficial ownership reporting is a linchpin in the machinery that ensures market efficiency, stability, and fairness – a trinity that, when maintained, fortifies the economy at large.

In sum, the importance of SEC Form 4 and the beneficial ownership reporting it encapsulates can hardly be overstated. For the investor seeking to make informed decisions, for the company aiming to preserve its credibility, and for the market striving to uphold its integrity, these disclosures form the connective tissue that bridges informational divides and inspires the confidence necessary to invest and trade with conviction.

Breaking Down Form 4 Filings

Delving into SEC Form 4 filings unveils a wealth of critical information for the discerning investor. Each document serves as a comprehensive ledger, encapsulating insiders’ convoluted transactions in a more digestible form. Essential for both maintaining regulatory compliance and providing pivotal insights into securities trading, Form 4 plays a dual role in serving the interests of both the Securities and Exchange Commission (SEC) and the investor community.

The crux of these filings revolves around the changes in beneficial ownership of company stock. Company insiders – including directors, officers, and substantial shareholders – must file SEC Form 4 to report any transactions that alter their ownership positions in a public company’s securities. Such changes might encompass purchases and sales in the open market, exercising stock options, or passing on shares as bona fide gifts, each annotated with specific transaction codes that shed light on the nature of the transaction.

This accessibility to insider trading data offers a glimpse into the sentiment within the company’s upper echelons. High frequency of insider buying may signal a bullish outlook, potentially tipping off investors to an undervalued stock ripe for acquisition. On the flip side, consistent selling can be a bearish harbinger, indicating potential troubles on the horizon, prompting investors to reconsider their stakes. SEC Form 4, reported within two business days of the transaction, ensures the market receives these insights with little delay, allowing for swift investor reaction.

Beyond mere transaction tracking, Form 4 disclosures include additional details that convey the broader context of each insider’s decisions. From price quantities to dates, and from derivative securities to the balance of acquisition and dispositions, the form is an invaluable instrument for investors seeking to decrypt insider motivation, gauge market sentiment, and determine the timing of their own trades. The filings also contribute significantly to building a narrative of corporate financial health, as they reflect the actions of those best positioned to assess the company’s short-term and long-term prospects.

For those looking to acquire advanced market knowledge and exercise due diligence, breaking down SEC Form 4 filings is not just a task – it’s a strategic endeavor. Through careful analysis of these forms, investors leverage the accrued data to calibrate their market hypotheses, optimize their trading strategies, and safeguard their financial assets against the inherent volatility of stock trading. Thus, SEC Form 4 stands as a beacon of transparency and analytical opportunity in the complex seas of the financial markets.

Components of Form 4: Header, Summary, Remarks, and Signature

| Component of Form 4 | Description | Investor Implication |

| Header | Identifies the filer, title, and company ticker symbol. | Provides context about the insider’s role in the company. |

| Summary | Itemizes securities bought, sold, or transacted. | Offers a snapshot of the insider’s recent trading activities. |

| Remarks | Additional explanations for transactions. | Can offer insights into the reasons behind an insider’s trades. |

| Signature | Legal attestation to the accuracy of the information. | Ensures the authenticity and accountability of the filing. |

Peering into an SEC Form 4 unveils a formal structure divided into key sections, each offering unique insights into insider transactions. This form, synonymous with the Securities and Exchange Commission’s commitment to transparency, consists of several components that build the narrative of insider trading activities. Investors who grasp the signals conveyed within the Header, Summary, Remarks, and Signature sections can gain a nuanced understanding of company insiders’ behaviors and the implications for the stock they are invested in or considering.

The Header: Identifying the Filer

At the forefront of Form 4 is the Header, which provides essential identification information about the insider. Here, you can find the filer’s name, title within the company, and the company’s ticker symbol—an initiation into the filing that sets the stage for the details that follow. The Header is where insights into the insider’s relationship to the company begin, offering context for the transactions detailed in the sections below.

The Summary: A Transactional Overview

Following the Header is the Summary, a section designed to offer a bird’s-eye view of the insider’s trading activities. It itemizes the securities bought, sold, or otherwise transacted by the insider, encompassing equity securities, derivative securities, and any changes in beneficial ownership. Transaction codes within this section provide a lexicon to decipher the nature of each action, whether it be an acquisition (A), a disposition (D), or a conversely significant event like the exercise of stock options (M).

The Remarks: Additional Context

In the Remarks section, filers have the opportunity to provide additional context or explanations for the transactions reported. This section can be particularly insightful for investors looking to understand the motivations or circumstances behind insider trades. It’s where nuances such as personal loans, investor education efforts, or planned trading schedules might be detailed, offering a deeper dive into the choices driving the transactions.

The Signature: Legal Attestation

The document culminates with the Signature, which serves as a legal attestation to the accuracy of the information presented. The insider’s signature here is a testament to their declaration that the transactions and securities holdings are reported in good faith, aligning with the legal obligations under federal securities laws.

Understanding each component of SEC Form 4 and the depth of market insight they provide is essential for investors looking to leverage this pivotal source of insider trading data. By breaking down each section and synthesizing the data within, investors arm themselves with the knowledge necessary to interpret the intent and implications of insider transactions on market dynamics.

Understanding Transaction Codes and Their Meanings

| Transaction Code | Meaning | Investor Interpretation |

| P (Purchase) | Direct purchase of securities. | May indicate insider confidence in the company’s prospects. |

| S (Sale) | Sale of securities. | Could suggest insider concerns about future performance. |

| M (Exercise of Options) | Exercise of stock options. | Reflects insider decisions on stock value and company outlook. |

| G (Gift) | Gift of securities. | Often a neutral action, not directly tied to company outlook. |

At the heart of an SEC Form 4 filing lies a set of transaction codes – each a miniature gateway into the minds of company insiders as they navigate the buying, selling, and management of their organization’s securities. Learning to interpret these transaction codes is essential for investors who seek to unravel the implications behind every insider trade, a process that enhances the richness of market research and can potentially shape investment decisions.

Each code found on an SEC Form 4 conveys a distinct type of transaction executed by company insiders such as directors, officers, or those holding above ten percent of a company’s stock – the so-called “beneficial owners.” By sifting through these codes, investors glean insights into not only market trends but also individual behaviors within the corporate hierarchy that could signal shifts in business strategy or fiscal health.

For instance, a transaction code ‘P’ indicates a direct purchase of securities, often reflecting insider confidence in the company’s future. Conversely, code ‘S’ represents a sale, which could suggest a range of motivations—perhaps a bearish outlook or a simple diversification of personal assets. Codes such as ‘M’ to report the exercise of options or ‘G’ for gifts of securities further detail the myriad ways insiders interact with their shares.

Other significant transaction codes include those representing derivative securities-related movements – from converting options to acquiring or disposing of the underlying stock. Additionally, derivative-related codes help investors evaluate whether transactions stem from individual investment strategies, involve pre-arranged trading plans under Rule 10b5-1, or are part of a broader equity compensation schema.

Parsing these codes represents more than simple numerology; it is akin to learning a new language that describes the intricate dance of insider trading dynamics. By integrating transaction code knowledge with market trends, regulatory conditions as informed by federal securities laws, and the SEC’s transparency initiatives, investors build a well-rounded and informed approach to their securities analysis and investment practice.

Unraveling the subtleties embodied within these transaction codes leads to a more profound understanding of the complex and often opaque landscape of the stock market. For those committed to enhancing their fiscal acumen in the securities exchange market, mastering the language of SEC Form 4 transaction codes is an invaluable investment in their financial literacy and a step towards achieving their investment objectives.

Filing Requirements: Deadlines and Who Must File

In the realm of financial regulation, precise filing requirements and deadlines are vital in sustaining the transparency and efficiency of the securities market. SEC Form 4, a document critical to illuminating the actions of company insiders, has stringent requirements about who must file and when they must do so—guidelines that are anchored in the Securities Exchange Act of 1934 and further defined by the U.S. Securities and Exchange Commission (SEC).

Insiders—specifically, officers, directors, and significant shareholders of publicly traded companies—are obligated to promptly disclose their securities transactions. This includes any individuals or entities who own more than ten percent of any class of a company’s equity securities. They navigate the labyrinth of the financial markets not just as participants but as sculptors of market perception, and hence are required to submit Form 4 to furnish investors and the SEC with timely updates on their transactions.

The deadline for filing is unambiguous—SEC rules mandate that Form 4 must be filed within two business days after the transaction occurs. This swift timeline underscores the SEC’s objective to keep the market well-informed and ensure that investors have access to information that may impact their investment decisions. It’s a regulatory mechanism designed to prevent improper use of inside information and maintain an equitable trading environment.

Understanding the nuances of these filing requirements is beneficial for both the insiders who must comply and the investors who rely on the data. Insiders must be attuned to the implications of their filings, as these documents bear legal significance and can affect investor relations and corporate reputation. For investors, the filings signal fluctuations in insider confidence and may provide clues to shifts in the company’s financial landscape.

Furthermore, the SEC’s EDGAR system facilitates public access to these filings, contributing to the broader transparency initiatives championed by the commission. As such, SEC Form 4 is not only a requirement but also a critical instrument in fostering a culture of compliance and diligence within the securities exchange market, underpinning the mutual relationship between the company insiders, the regulatory authority, and the investor community.

Key Terms and Acronyms Explained

Navigating the intricacies of SEC Form 4 filings means becoming fluent in the language of insider trading—a language replete with specialized terms and acronyms that carry significant weight in the context of the securities exchange market. Investors who take the time to understand this language can gain a deeper insight into the transactions of company insiders and how these actions can potentially influence the stock market.

A fundamental term that appears across these filings is ‘beneficial ownership,’ which refers to the rights to enjoy the benefits and proceeds from a security. Beneficial owners are recognized as having a stake in the company that extends beyond mere possession, providing them with the power to influence or make decisions regarding the company’s securities.

‘Securities,’ a broad term encapsulating stocks, bonds, options, and an array of financial instruments, represent the investment landscape insiders operate within. A thorough grasp of different securities, especially ‘equity securities’ such as common stock, is critical as each carries distinct reporting obligations and market implications.

Another pivotal term is ‘transaction codes,’ which are used in Form 4 filings to denote the nature of an insider’s transaction—whether it’s acquiring or disposing of stock (‘A’ or ‘D’), exercising options (‘M’), or transacting through various other means that insiders may legally engage with.

Understanding the distinction between ‘direct’ and ‘indirect’ ownership is also critical. Direct ownership implies that the securities are held in the insider’s name, while indirect ownership could involve a relationship or entity (like a trust or family member) through which the insider exercises control or influence over the securities.

Key acronyms such as ‘EDGAR’ (Electronic Data Gathering, Analysis, and Retrieval) represent the SEC’s database where all these forms are filed and made publicly accessible. Meanwhile, ‘SEC’ not only stands for the Securities and Exchange Commission but symbolizes the very framework of U.S. financial regulation itself.

By delving into these terms and acronyms, investors embolden their investing arsenal, enabling them to decode the filings more efficiently and align their strategies with the nuanced shifts in insider trading activities.

Common Stock, Derivatives, Securities, Options, and Equities

In the arsenal of financial instruments, common stock, derivatives, securities, options, and equities comprise the quintessential components of investment portfolios and are often the subject of transactions disclosed in SEC Form 4 filings. For investors, understanding these instruments is not just beneficial—it’s essential to make sense of the subtle and not-so-subtle messages relayed by insiders through their market activities.

Common stock, representing ownership stakes in a company, is the bedrock upon which many investment strategies are built. When insiders trade common stock, they send clear signals to the market regarding their belief in the company’s future prospects or their assessment of its current valuation.

Derivatives are complex financial securities derived from an underlying asset or group of assets. These often encompass options, warrants, and futures—each with unique characteristics and implications for insider trading insights. For example, when insiders exercise derivatives like stock options, they buy or sell the stock at a predetermined price, which might suggest they perceive a discrepancy between the market price and the future value of the stock.

Then there are securities, a broad term that envelops various tradable financial assets including stocks, bonds, and mutual funds. Insiders must report all transactions involving securities, and investors keen on analyzing these transactions consider how certain trades align with broader market trends or internal company developments.

Equities, synonymous with stocks, reflect ownership interest in a firm and are a cornerstone of corporate finance and investment — whether trading on the New York Stock Exchange or being part of a Silicon Valley startup’s compensation package. Insider transactions in equities can offer a read on sector momentum, management’s view on valuation, or response to material business events.

For those seeking to harness the knowledge contained within SEC Form 4 filings, comprehension of these financial instruments—and the manner in which they are traded by insiders—can be the linchpin for an informed and tactical approach to stock market participation. It’s this interplay of company transactions in common stock, derivatives, securities, options, and equities that forms a mosaic of market intelligence, crucial for those looking to interpret the impacts on stock price, ownership securities, and the financial health of public enterprises.

Insider Trading, Beneficial Ownership, and Derivative Security

In the pursuit of market wisdom, three fundamental terms often emerge at the heart of the conversation: insider trading, beneficial ownership, and derivative security. These key phrases encapsulate critical aspects of the financial industry’s regulatory landscape and are paramount in the analysis of SEC Form 4 disclosures—documents that mark the intersection of corporate transparency, insider activity, and market dynamics.

Insider Trading: In the public vernacular, insider trading is often synonymous with illegal conduct, yet in its broader legal context, it refers to the transactions of corporate insiders who buy and sell company stock within the confines of federal securities law. These trades, reported on SEC Form 4, hold significant weight for investors as they can signal insider sentiment—whether bullish or bearish—towards their company’s prospects, providing an insight into anticipated movements in the stock market.

Beneficial Ownership: A term that underscores the relationship between possession and power, beneficial ownership reveals who truly stands to gain from a company’s performance. It includes those with indirect stakes facilitated by entities such as trusts or investment groups, and requires detailed SEC filings to chart the intricate map of ownership beyond simple equity stakes. This reporting illuminates the landscape of vested interests, educating investors on who maintains influence over a company’s strategic direction, even if they do not control the securities directly.

Derivative Security: As instruments that derive their value from underlying assets such as stocks, bonds, or indices, derivatives are much more than simple financial tools—they are the instruments of strategic sophistication in investment portfolios. They often manifest in forms like options and futures and are key features in executive compensation and hedging strategies. The use of derivatives by insiders, documented within SEC Form 4 filings, provides invaluable insights, potentially revealing leverage, hedging activities, or speculative positions that could impact a company’s stock price.

Understanding these nuances paints a crystal-clear picture for investors regarding the implications of insiders’ actions on their own market strategies. SEC Form 4 reports are the written chronicles of such transactions, imbuing investors with the ability to decode complex insider narratives and make informed decisions in an endlessly evolving securities exchange landscape.

Reading the EDGAR System for Access to SEC Filings

Investors looking for the bedrock of U.S. securities market transparency inevitably turn to the Electronic Data Gathering, Analysis, and Retrieval system, better known as EDGAR. Administered by the Securities and Exchange Commission (SEC), this comprehensive system offers a public window into the filings that shape market perception and influence investor decisions—including the critically observed SEC Form 4 filings related to insider trading.

Accessing the wealth of information available through the EDGAR system can be likened to navigating a vast repository of financial intelligence. It provides a platform where the filings that keep the financial wheels turning—be it insider transactions, periodic reports, or prospectuses—are made available to anyone with an interest in the securities exchange market.

For the uninitiated, maneuvering through EDGAR to find specific SEC filings like the Form 4 can seem daunting. Yet, understanding how to effectively parse the EDGAR database is paramount for those who wish to leverage the insights contained within. Key filings disclose not only insider activities but also broader corporate events, beneficial ownership stakes, and complex financial structures involving derivatives and other equity securities.

Investors harness EDGAR as a powerful tool for due diligence and research. By honing their ability to locate, read, and interpret the granular data in these filings, they gain competencies that can lead to better-informed investment choices. SEC Form 4 filings, in particular, are sought after for the immediacy of the information they provide, revealing insider transactions with precision, often before the effects ripple into the broader market.

Moreover, EDGAR serves as a beacon of SEC transparency. It is an embodiment of the federal securities laws that demand disclosure — laws that enable investors to act on reliable, timely information, fortifying their understanding of company insider sentiments, market trends, and the broader regulatory environment that governs corporate America.

Familiarity with the EDGAR system equips investors with the acumen to extract vital insights from the SEC’s filings, insights that are sometimes encoded in complex transaction details or nestled within legal terminologies. In the hands of knowledgeable investors, EDGAR becomes more than just a database—it becomes a compass that directs them towards market opportunities and away from potential pitfalls.

Insider Transactions: A Closer Look

Diving deep into the world of insider transactions opens up a nuanced understanding of the financial maneuvers that occur behind the scenes of publicly traded companies. These transactions, dutifully recorded on SEC Form 4, represent more than just routine disclosures – they hold the potential to yield insights into a company’s future and reflect the sentiments of those at the helm.

Insiders, including directors, officers, and large shareholders, are often privy to material nonpublic information that could influence the company’s stock value. Their trading actions – whether buying shares, selling them, exercising stock options, or engaging in other securities transactions – are meticulously documented and released to the public via the EDGAR system, often under the stringent timeline of being reported within two business days following the transaction.

Investors who pay close attention to these insider transactions are frequently looking for clues that may inform their investment strategies. A series of acquisitions by multiple insiders, for instance, could indicate an undercurrent of optimism within the company, potentially signaling a bullish outlook. Conversely, insider sales could suggest internal concerns about the company’s future prospects, possibly heralding a bearish trend.

Analyzing these transactions necessitates understanding not only the basic actions of buy and sell but also the subtleties involved in derivative securities, grants of equity compensation, and changes in beneficial ownership. Moreover, the price at which these transactions occur, as well as the quantity and timing relative to certain company events, can provide crucial context for investors.

Insider transactions may impact perceptions of equity securities beyond immediate price fluctuations. They can also convey long-term confidence or caution, affecting the market’s perception of the company’s creditworthiness, investor relations, and overall industry standing. Those who equip themselves with the knowledge of how to interpret SEC Form 4 filings can thus gain a more profound grasp of corporate insider dynamics and the broader financial landscape.

By scrutinizing these filings, investors can make more educated decisions, connecting the dots between insider activities and larger market trends. This section will delve into the various aspects of insider transactions, providing a deeper look at their significance in the financial markets, and helping investors decipher the often complex web of insider dealings.

Types of Transactions Recorded on Form 4: Purchases, Sales, Gifts, and Options Exercises

When deciphering SEC Form 4, it is crucial to understand the diverse nature of transactions that company insiders are required to report. These transactions, from purchases and sales to gifts and stock options exercises, each bear distinct implications for investor comprehension and market speculation. By dissecting the types of transactions recorded on Form 4, investors and analysts gain profound insights into the financial behaviors and strategies of corporate insiders – insights that could be predictive of future market movements.

Purchases (Acquisitions) – A purchase of stock reported on SEC Form 4 signals an insider’s direct increase in beneficial ownership and is often interpreted as a bullish indicator. This action may express the insider’s confidence in the future performance of the company and, consequentially, its stock price—compelling information for shareholders and potential investors alike.

Sales (Dispositions) – Sales of securities by insiders can reflect a variety of motivations; sometimes, they are bearish indicators that executives or directors expect the company’s stock to underperform or are seeking to diversify their investments. Other times, sales are part of individual financial planning or liquidity needs rather than commentary on company value.

Gifts – While less common, gifts of securities are another transaction type insiders report with distinct transaction codes on Form 4. Gifts do not necessarily reflect the insider’s sentiment towards the company’s future, but they do contribute to changes in the distribution of equity and beneficial ownership that can impact control dynamics within a company.

Option Exercises – Insiders often receive stock options as part of their compensation packages. The exercise of such options, becoming common stock, reveals not only changes in the ownership stake but also decisions insiders make about the perceived value of exercising these options versus allowing them to lapse. This reflects their calculation of market prices relative to the strike price set within the options—a critical element in valuing insider sentiment.

Analyzing the details of these transactions, both in isolation and as a confluence of insider activities within a reporting period, can offer a broader picture of market sentiment. Investors who closely monitor these Form 4 filings and comprehend their significance stand to benefit from this timely data disclosed under the stringent requirements of the Securities Exchange Commission, designed to preserve market integrity and investor trust.

By understanding the traits of each transaction type and interpreting them within the wider context of market conditions and company-specific developments, stakeholders can make more educated decisions, adding layers of strategic analysis to their investment approaches. As we explore SEC Form 4, we delve into the heart of insider transactions, decoding the substratum of the financial market.

Analyzing Transaction Types: Open Market, Private Transactions, and Derivative Positions

Understanding the intricacies of stock transactions is pivotal for investors, insiders, and regulatory bodies alike. The SEC Form 4 is key in providing transparency into the trading behaviors of company insiders, a requirement that maintains the integrity of the securities market. By analyzing the nature of transactions such as open market and private transactions, as well as the complexities of derivative positions, we can glean insights into the strategic moves of company directors, officers, and significant investors, and how they may influence stock prices and investor sentiment.

Open Market Transactions

In the realm of the open market, company insiders buy and sell shares on public exchanges—a process observed closely by the Securities Exchange Commission (SEC). These transactions, often executed through broker-dealer agents, are straightforward in their intent and impact. They are indicative of an insider’s confidence or skepticism about the company’s future and are reflected in real-time within the stock market. The frequency and volume of such transactions can be a barometer of insider sentiment, with rapid buying often considered a bullish sign, while accelerated selling may signal bearish prospects.

Private Transactions

Private transactions, including stock options and equity securities, are transactions arranged outside the public sphere. Sometimes referred to as “dark trades,” these dealings can include everything from executive compensation in the form of securities to negotiated sales or transfers that might not immediately affect market price. The beneficial ownership disclosures from such transactions are critical for gauging shifts within company ownership and management structures. Although they must be reported within business days to the SEC, they generally do not attract the same immediate visibility as open market actions.

Derivative Positions

Derivative securities, such as options, swaps, and futures, represent a more sophisticated and multilayered investment mechanism. For insiders, these financial instruments allow for strategic positioning—hedging against potential downturns or amplifying gains without directly influencing the current stock price. Derivative positions can be complex, involving various transaction codes, and often form part of a broader trading plan. Their impact, while sometimes opaque to the average investor, can have long-term implications on investor relations and corporate strategy.

As we dissect these categories, we unravel the complexities of the insider trading landscape, pondering the ethical and legal implications, and striving to understand how these trades shape the broader narrative of company health and market dynamics.

Insider Groups: Directors, Officers, and Large Shareholders

Within the intricate fabric of the stock market, the transactions of insider groups such as directors, officers, and large shareholders are meticulously scrutinized. These individuals, often in possession of critical and sensitive company information, play a vital role in shaping investor perceptions through their trading activities. The filing of an SEC Form 4 provides a legal framework for these insiders to report their securities transactions, offering invaluable insights into the inner workings and future prospects of companies they govern or hold significant stakes in.

Directors and Officers

Company directors and officers, entrenched in the daily operations and strategic planning of their businesses, are integral components of insider trading analysis. Their trading behaviors—whether purchasing or selling shares, exercising stock options, or other forms of equity securities transactions—reflect their views on the company’s health and future performance. These transactions are often seen as indicators of confidence or concern, influencing investor relations and potentially swaying the market. The SEC Form 4 filings elucidate the accumulation or liquidation of these insiders’ positions, reinforcing or undermining the market’s trust in the company’s direction.

Large Shareholders

Large shareholders, embodying institutional investors, hedge funds, and major individual stakeholders, command attention with their ownership changes and their potential to sway stock prices. These entities and individuals, by virtue of their significant holdings, have the power to enact profound impacts on market dynamics and company valuation through their trading decisions reported on SEC Form 4. When large shareholders engage in accumulating or reducing their stakes, they’re not merely adjusting their investment portfolios; they’re providing cues to the market about the perceived value and prospects of the company shares they trade.

In the financial ecosystem, the transactions of these insider groups form a foundational element of investor research and market analysis. The SEC Form 4, by capturing the trading nuances of directors, officers, and large shareholders, serves as a beacon of transparency. It underscores a commitment to fair trading practices and ensures that all market participants have access to vital information regarding insider movements. As such, understanding the motivations and implications behind the transactions of insider groups remains a pivotal aspect of navigating the securities exchange and safeguarding the integrity of investment decisions.

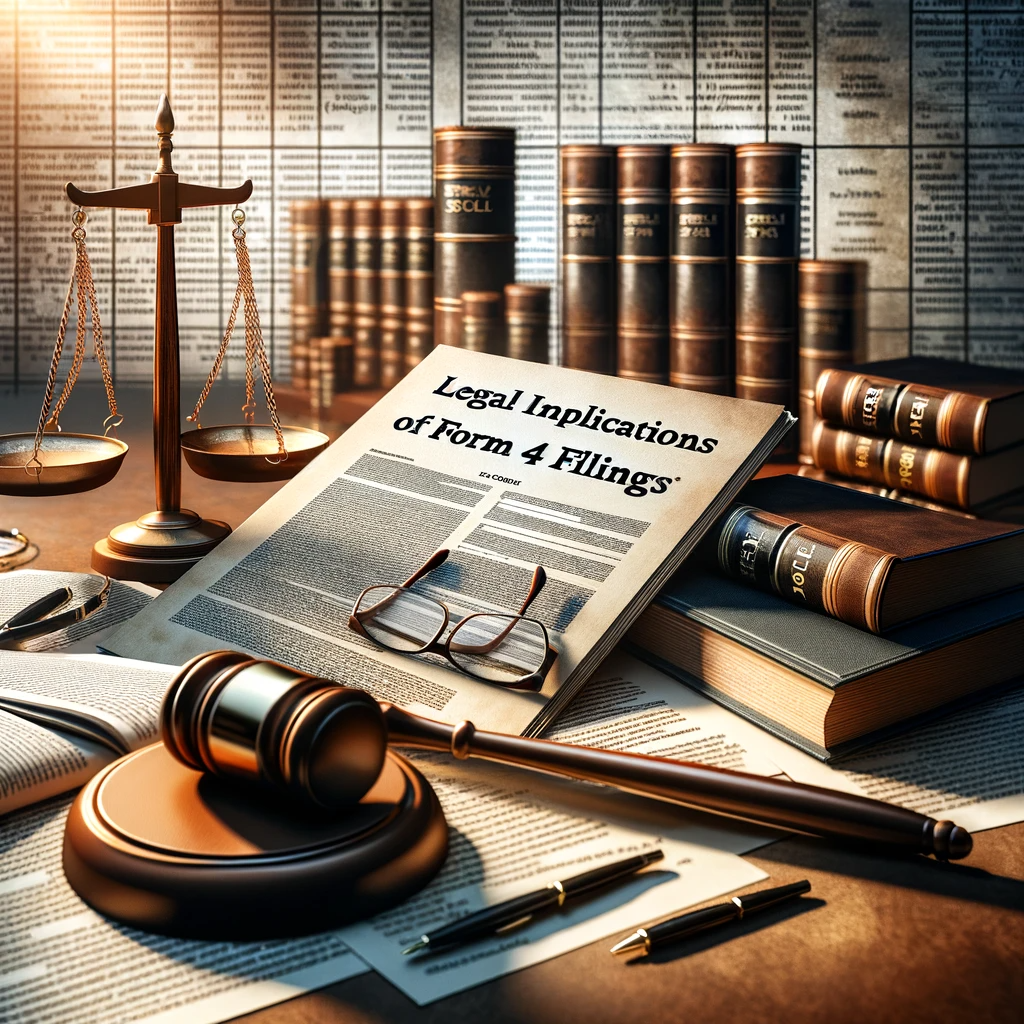

Legal Implications of Form 4 Filings

The filing of SEC Form 4 is enveloped by a legal framework designed to promote market transparency and prevent illegal insider trading. Given the potential influence of insider transactions on stock prices and investor trust, these filings are not solely routine disclosures; they are also a linchpin in the enforcement of securities laws. By delving into the legal implications of Form 4 filings, we unravel the complex tapestry of compliance requirements that directors, officers, and significant shareholders must navigate to maintain the fidelity of financial markets.

Market Transparency and Disclosure

SEC Form 4 is synonymous with safeguarding an equitable trading landscape. The Securities Exchange Commission (SEC) requires that insiders report trades involving stock options, common stock, and derivative securities within stringent timelines—typically two business days after the trade date. This ensures that all market participants have timely access to information that could impact their trading decisions, thus preserving market integrity and fostering investor confidence.

Insider Trading Regulations

Legal implications of non-compliance with Form 4 filings are serious and can include sanctions, fines, or criminal charges. Form 4 submissions are integral to the SEC’s oversight function, aiding in the detection of noncompliance with rules addressing insider trading. They help the SEC to monitor whether insiders are using nonpublic, material information for personal gain, thus infringing on federal securities laws aimed at protecting investors and the broader markets.

Corporate Governance and Shareholder Confidence

Accurate and punctual Form 4 filings are reflective of robust corporate governance. They influence investor relations, as they are indicative of a company’s commitment to transparency and adherence to legal standards. Investors scrutinize these filings for signs of alignment or divergence between insider actions and the anticipated direction of business strategy and financial performance.

Navigating the legal landscape of Form 4 filings is essential for corporate insiders to avoid the pitfalls of regulatory non-compliance and for investors to assess the ethical stature of the companies they invest in. As we dissect the legal context of these filings, their role in deterring insider trading malpractices becomes increasingly evident. Moreover, these filings uphold the sanctity of the securities market by cementing a culture of integrity, openness, and respect for the rule of law—principles that are cornerstones of a dynamic and trustworthy financial system.

Federal Securities Laws and Insider Trading Regulations

The lattice of federal securities laws, encompassing acts and regulations, sets the stage for legal protocols around transactions recorded in SEC Form 4 filings. The implications of such filings stretch well beyond the mere listing of insider transactions; they serve as a beacon for legal compliance and oversight in the domain of insider trading. These filings, requisite for officers, directors, and large shareholders, are critical for upholding the integrity and fairness of the securities market and enforcing the prohibition against illegal insider trading.

Understanding the Securities Exchange Act

At the heart of these securities laws is the Securities Exchange Act of 1934, often referred to simply as the Exchange Act, which governs the trading of securities on U.S. exchanges. The Exchange Act mandates timely disclosure of material information that could impact an investor’s decision, thereby ensuring that all market participants operate on a level playing field. Form 4 serves as a vital instrument within this framework, as it must detail specific transaction codes and the acquisition or disposition of equity securities within business days of the transaction.

Combating Insider Trading

Insider trading regulations are designed to prevent insiders, who have access to material nonpublic information, from engaging in transactions that capitalize on this knowledge before it becomes available to the public. Form 4 plays a crucial role by recording insider transactions, thus allowing regulatory bodies like the SEC to monitor and, if necessary, investigate suspicious trading patterns that suggest the misuse of confidential information. The SEC’s rigorous enforcement of these regulations helps maintain public confidence in the fairness of the stock market.

Interplay with Federal Securities Laws

The interplay between Form 4 filings and the broader scope of federal securities laws—like the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Sarbanes-Oxley Act—illustrate the ongoing evolution of regulations that seek to clamp down on financial improprieties. These legislations strengthen reporting requirements, enhance whistleblower protections, and increase the accountability of corporate executives, thereby reducing the likelihood of fraudulent activities within the financial markets.

Navigating the intricate web of federal securities laws and insider trading regulations requires a thorough comprehension of legal obligations and the consequences of noncompliance. The analysis of Form 4 filings, from open market to private transactions and derivative positions, not only provides a snapshot of insider confidence but also serves as a measure of adherence to the stringent standards set forth by the SEC. Through the diligent examination of these documents, stakeholders gain assurance that the veneer of corporate transparency is backed by stringent legal adherence, contributing to a robust and equitable trading environment.

Penalties for Failing to File or Filing Inaccurate Reports

The act of filing SEC Form 4 is not just a procedural step for company insiders—it’s a legal obligation under federal securities laws. The securities market thrives on the transparency and trust established by accurate and timely disclosures. When insiders fail to file these crucial documents, or if the reports are marred by inaccuracies, they risk triggering a series of penalties that underscore the seriousness with which the Securities Exchange Commission (SEC) and other regulatory bodies view these infractions.

Legal Repercussions for Non-Compliance

Stringent measures await those who navigate the tightrope of securities exchange and fall afoul of the rules. Non-compliance with filing deadlines, failure to report the details of insider transactions, or the submission of reports that contain material misstatements can lead to fines, sanctions, and disgorgement of profits gained from any improper trading. In more severe cases, the SEC can pursue legal action that leads to the bar on serving as an officer or director of a public company, or even criminal charges.

Financial Consequences and Market Impact

The penalties for failing to file or inaccuracies in filings are not solely limited to legal actions. Such lapses can also have substantial financial implications for the individuals involved and potentially affect the market perception of the company. Late filings can result in monetary penalties, which might seem minor, but repeated misconduct can damage an insider’s reputation, leading to a decline in investor confidence and, consequently, a potential drop in stock prices.

Corporate Accountability and Governance

Corporate governance plays a pivotal role in ensuring adherence to filing requirements. Not only are individuals held responsible for their filing obligations, but the companies themselves may also face consequences if they inadequately supervise or fail to implement procedures that guarantee compliance. Companies that cultivate a culture of transparency and strict compliance help protect themselves and their insiders from the potentially grave repercussions of filing oversights.

Penalties for non-compliance with Form 4 filing requirements are an essential deterrent to insider trading and inaccuracies in the disclosure of securities transactions. The legal and financial ramifications reiterate the importance of these filings in maintaining an orderly and equitable market, upholding investor trust, and ensuring that the company’s officers, directors, and significant shareholders abide by the highest standards of financial reporting and corporate responsibility.

The Major Questions Doctrine and Its Relevance to Form 4 Compliance

When it comes to regulatory compliance and the labyrinth of federal securities laws, the major questions doctrine emerges as a significant legal principle, embodying the essence of judicial scrutiny over agency decision-making. This doctrine, while not directly related to the routine filings of insider trading such as the SEC Form 4, holds implications for the overarching regulatory environment in which such compliance takes place. The relevance of the major questions doctrine weaves into the fabric of Form 4 filings, as it may influence the interpretation and enforcement of federal securities laws by limiting the extent of regulatory authority without clear congressional mandate.

Interpreting Federal Securities Law and SEC Oversight

The major questions doctrine plays a pivotal role in the way federal securities laws are interpreted, particularly when it comes to the Securities Exchange Commission’s authority to enforce insider trading regulations. This legal principle insists on clear congressional authorization for decisions of vast economic and political significance, which potentially guides how the SEC oversees the compliance of company insiders with Form 4 filing requirements. The transactions disclosed in these filings, especially regarding derivative securities, stock options, and equity securities transactions, must tread cautiously within the bounds of regulatory requirements that are shaped by this doctrine.

Regulatory Clarity and Insider Trading

For insiders, the clarity with which federal securities laws are outlined and enforced is paramount to their ability to remain compliant. The major questions doctrine underscores the importance of transparent and precise regulations to ensure that insiders are aware of their obligations, particularly in complex areas of the law that govern trading plans, material nonpublic information, and the securities exchange act. This clarity directly impacts the effectiveness with which insiders can navigate their Form 4 reporting duties, thus avoiding potential risks associated with the filing of inaccurate reports or failure to file.

Form 4 Compliance in the Shadow of Judicial Interpretation

The relevance of the major questions doctrine to Form 4 compliance cannot be underestimated. As federal agencies, like the SEC, exercise their regulatory authority, they must do so with consideration for the limits imposed by this doctrine. The potential for courts to review and possibly curtail agency action places additional pressure on the precise articulation of rules that govern Form 4 filings and insider transactions. Subsequently, the doctrine may affect not just how laws are interpreted, but also how companies and their insiders develop internal policies to promote steadfast compliance.

In the intricate interplay between federal securities regulation and judicial oversight, the major questions doctrine serves as a bastion of the balance of power, ensuring that financial market regulation by the SEC, particularly concerning Form 4 filings, operates within its intended scope. Through the lens of this doctrine, we perceive the careful tension that must be maintained between robust market oversight and the strictures of authorized regulatory power.

How to Access and Read SEC Form 4

Navigating the financial landscape requires adeptness in accessing and interpreting critical documents, and SEC Form 4 is pivotal for those tracking insider trading actions. This form is the cornerstone of insider trading transparency, granting investors a glimpse into the buying and selling behaviors of company directors, officers, and large shareholders. For stakeholders looking to parse through the slew of information that SEC Form 4 presents, it is essential to not only access this document but also understand the intricacies of its contents.

Accessing SEC Filings on EDGAR

The first step in this journey is accessing SEC Form 4 filings, which are publicly available on the SEC’s Electronic Data Gathering, Analysis, and Retrieval system (EDGAR). EDGAR provides an open platform where individuals can search and download filings, ensuring that the information disseminated is current and reflective of the latest insider transactions. Whether it’s information about open market purchases, stock options, or derivative securities, EDGAR serves as a comprehensive repository for all investors, from Silicon Valley veterans to Wall Street novices.

Understanding Form 4 Filings

Once accessed, the challenge lies in deciphering the information Form 4 presents. Insider transactions are encoded with specific transaction codes, which reflect the nature of the trade—be it an acquisition, disposition, or conversion of derivative securities into common stock. Additionally, insightful details such as the trading date, transaction price, and the resulting ownership stakes post-transaction are crucial in gauging the insider’s market moves. A well-informed investor not only reads the filing but also comprehends it in the context of the market pricing, industry trends, and the company’s fiscal year performance.

Reading Between the Lines

Beyond the apparent transaction details, reading SEC Form 4 involves understanding the subtleties behind the reported actions, such as the motives for insider buying or selling and the implications of such moves. Are insiders showing confidence in their company securities, or are they hedging against potential downturns? Does a flurry of insider trading signal bullish industry prospects or raised red flags for regulatory scrutiny? The ability to interpret these nuances can give savvy investors an edge in the marketplace.

Understanding how to effectively access and read SEC Form 4 is imperative for anyone involved in the securities exchange commission’s intricate dance. It allows investors to derive actionable intelligence from these filings, providing a forensic toolkit for financial analysis and informed decision-making. As we peel back the layers of Form 4 filings, we empower market participants with the knowledge to both comply with federal securities laws and capitalize on market opportunities.

Using the EDGAR System to Find and Read Insider Trading Reports

The Electronic Data Gathering, Analysis, and Retrieval system, commonly known as EDGAR, is the Securities Exchange Commission’s (SEC) electronic filing system where public access to insider trading reports, including SEC Form 4, is provided. In the digital age, EDGAR stands as an indispensable resource for investors, financial analysts, and the general public seeking insights into the market-affecting movements of corporate insiders. Navigating this database effectively is essential for those aiming to harness the wealth of information it contains regarding insider trading activities.

Locating Insider Trading Reports on EDGAR

EDGAR’s user-friendly interface facilitates the search for insider trading reports, which are mandatory for company insiders who engage in transactions involving their own company’s securities. These individuals—as directors, officers, or holders of more than 10% of any class of a company’s shares—are required to file reports that record their transactions, thereby enhancing transparency within the market. By utilizing EDGAR, one can easily access these filings, which include not only Form 4 but also Forms 3 and 5, depending on the nature of the insider’s relationship with the company and the type of transactions conducted.

Deciphering Insider Trading Information

Navigating through the EDGAR system and identifying relevant insider trading reports is just the opening act. The true challenge lies in decrypting the complex jargon and transaction codes found within these reports. Understanding the implications of specific codes, such as transaction code ‘M’ for the exercise of options, or code ‘G’ for a bona fide gift, is crucial in interpreting an insider’s investment strategy. Moreover, analyzing patterns in buying and selling, conversion rates of derivative securities, and comparing the transaction prices to market trends, can offer deep insights into where these company insiders see value and potential growth or risk in their own securities.

EDGAR as a Research and Compliance Tool

Beyond serving as a treasure trove of insider trading data for investment decisions, EDGAR is also a linchpin in maintaining a culture of compliance. The SEC’s requirement for timely, accurate filings on EDGAR ensures that insiders adhere to their legal obligations. For researchers and legal professionals, EDGAR provides a substantial legal repository to understand past and present regulatory stances and insider behaviors.

Mastering the EDGAR system to find and decipher insider trading reports is a necessary skill for those invested in the machinations of the stock market. As we unpack the layers of data available on EDGAR, we find not only the footprints of insider trading but also the echoes of market confidence, the whispers of forthcoming trends, and the rhythm of a regulated, transparent marketplace.

Adobe Reader and Acrobat Requirements for Viewing Filings

In today’s technologically sophisticated financial landscape, accessing crucial documents like SEC Form 4 filings involves more than just knowing where to look. Ensuring that you have the correct software to view these documents is equally essential. Adobe Reader and Acrobat have become the standard tools for opening and reading the comprehensive reports found on platforms such as the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. These Adobe products cater to a universal need for reliable access to the forms and filings that paint a detailed picture of insider trading activities.

Adobe Reader: The Key to Compliance Documents